-

How to start trading?

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

-

How to open an FBS account?

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

-

How to withdraw the money you earned with FBS?

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

Balance Sheet

Balance Sheet

The balance sheet knows everything! It can tell you whether a company has enough money to invest in its development and keep growing or it is deeply indebted.

What is a balance sheet?

A balance sheet is a financial record that uncovers the company's assets (what it’s already got) and liabilities (what it owes to others). It’s called a balance sheet as each side must equal the other. Assets equal liabilities plus shareholder equity. In other words, whatever assets aren’t being used to pay off the liabilities belong to the shareholders.

Assets = Liabilities + Shareholders’ Equity

The assets and liabilities are usually divided into two categories: current and non-current. Current assets can be converted into cash within a year, while non-current assets are considered long-term assets that can take a longer time to determine their full value. Current liabilities are due within one year, while long-term liabilities are due at any point after one year.

What you need to know about a balance sheet

Are there other financial statements?

The balance sheet is just one of the three core financial statements which also include an income statement and a cash flow statement. All of them present written records that reveal the financial performance of a certain company.

Where should you find the balance sheet?

The Securities and Exchange Commission (SEC) and its EDGAR website offer all sorts of balance sheet information. Use it to find the balance sheet of a company you are interested in.

How to read a balance sheet?

Balance sheets list periods (usually one year) vertically next to each other. This form allows investors to compare the different periods easily and assess the company’s financial condition and operating performance.

How do the earnings fit into the balance sheet?

You may notice "Retained Earnings" in the equity section at the bottom of the balance sheet. It is an important thing for investors to check. When a certain company earns some capital, it can choose to pay this money to shareholders as dividends or to keep these earnings to reinvest in its business. Thus, retained earnings are the historical profits, minus the dividends a company paid in the past.

Example of a balance sheet

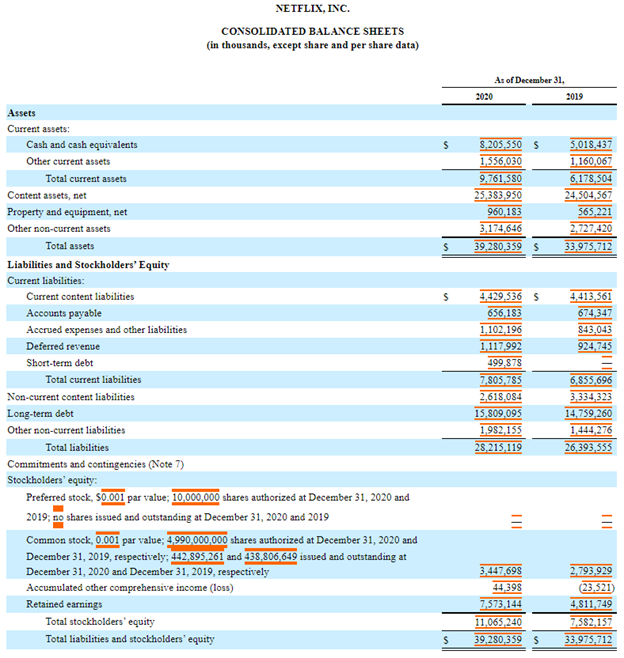

You can observe the balance sheet of Netflix below. It lists $39.28 million in assets for December 31, 2020. In 2019, it recorded $33.98 million—they acquired $5 million in assets over that period. Netflix increased its liabilities to $28.2 million, up from $26.4 million in 2019. After this brief analysis, an investor can see that Netflix has total current assets of $9.76 million and total current liabilities of $7.8 million. Thus, the company has more than enough to pay off its short-term debts.

If we divide current assets by current liabilities, we’ll get the current ratio. This measurement tests short-term financial risk. Netflix has a current ratio of 1.25. Some companies have higher and lower current ratios depending on their financial structure. In general, a company with assets and debt should have a current ratio of above 1 to stay afloat.

Other Useful Ratios

Quick ratio: (current assets - inventories) ÷ current liabilities

Debt to equity ratio: total liabilities / total stockholders' equity

Working capital ratio: current assets - current liabilities

Net worth: total assets – total liabilities

Debt-to-Equity Ratio: total liabilities ÷ shareholders' equity

It is significant to know how to read a balance sheet. This skill allows a person to invest in stocks not by intuition but in a professional way!

2024-03-14 • Updated